The 2010 Flash Crash is aptly named for the speed with which it happened. Within several minutes, the stock market took one of the biggest dives in its history, with the Dow Jones Industrial Average dropping nearly 9% and a full 998.5 points. If this is surprising news, it’s because most of the losses were promptly recovered in just minutes more.

Though it’s only in its infancy, High Frequency Trading (HFT) is estimated to make up more than half of the trades currently done in the stock market. HFT is done by robot software systems that use sophisticated algorithms to execute trades on an incredibly rapid basis. Unlike typical investors which track the market and often hold onto stocks for long periods of time, high frequency trading systems execute thousands of trades a day, with many trades completed in less than a second. By being able to complete so many trades daily, the software is able to look for small, but consistent payoff, instead of looking for stocks with a big profit margin but high risk.

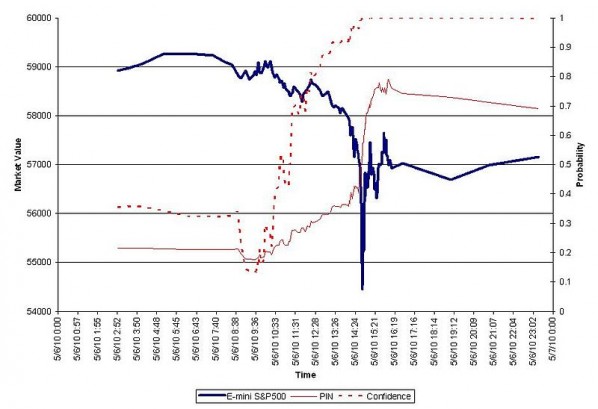

The speed of these transactions and their autonomous nature caused the Flash Crash to be both the worst and also the fastest stock crash. The stock market openned on May 6 to quickly face a 300 point drop attributed to worries about the impending debt crisis in Greece. The series of events that lead to the subsequent plummet are complicated and not agreed upon in exact terms by even financial experts. However, it is clear that HFT exaccerbated the crash. After one important seller sold an unsually large amount of stocks quickly in an already unsually declining market, computer algorithms used by normal investors and high frequency traders a like noticed the increase in selling decided to take drastic measures by buying and selling more rapidly than usually or, for some, withdrawing from the market completely to remove themselves from the crazed trading frenzy.

The market was paused by the Stop Logic functionality that pauses the market for 5 to 20 seconds to give the market the opportunity to catch up to equiliburium. In this time, the algorithms had enough time to realize that they had traded until a false perception of the market. After several minutes, the market began to stabilize and regain the 600 points it had lost in the minutes prior.

That the fate of the market was decided within minutes by robot traders is incredible. If robots are out to plan a societal take-over, it’s not by taking our doctors’ jobs or driving our cars that they will do it. Within minutes, whether caused by a mechanical malfunction, a software bug or a malicious programmer, a HFT robot could execute thousands of bad trades very quickly. Other HFT systems could sense the change in the market as quickly as it happened and cause a market crash even worse than the one in 2010.

HFT represents one of countless instances of implementing robot technology before the full implications of the system have been understood and evaluated. Even though a human can step in and override an algorithm if things get bad, the change in speed, from an algorithm’s millisecond calculation time to the “slow-mode” of a human, can disrupt the fast calculations of other HFT systems and cause them to trade poorly as well. Not enough has changed since the Flash Crash to prevent another incident. If we want to prevent a robot apocalypse of this magnitude from happening, we need increased regulation and increased understanding. While robots can improve efficiency, they are dangerous tools for doing so and should be used with caution. Being tempted by their advantages without understanding the risks involved is reckless and almost surely to result in dire consequences.